Hsa Contribution Limits 2025 Include Employer Match. Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2025, the irs said tuesday. Hsa contribution limits for 2025 are $4,150 for singles and $8,300.

Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2025, the irs said tuesday. While some hsa match strategies may drive more engagement compared to others, any match can be a powerful employee incentive.

The limit on contributions is based on the calendar year, meaning the irs prorates allowable contributions by the number of months an individual is eligible to contribute to an hsa.

Hsa contribution limits for 2025 for 2025, the contribution limits increase again, allowing you to save up to the following amounts:

Employee contribution limits for roth 401(k)s are $22,500 for 2025, and $23,000 for 2025, the same as traditional 401(k)s.

Significant HSA Contribution Limit Increase for 2025, The maximum amount of money you can put in an hsa in 2025 will be $4,150 for individuals and $8,300 for families. Hsa contribution limits for 2025 for 2025, the contribution limits increase again, allowing you to save up to the following amounts:

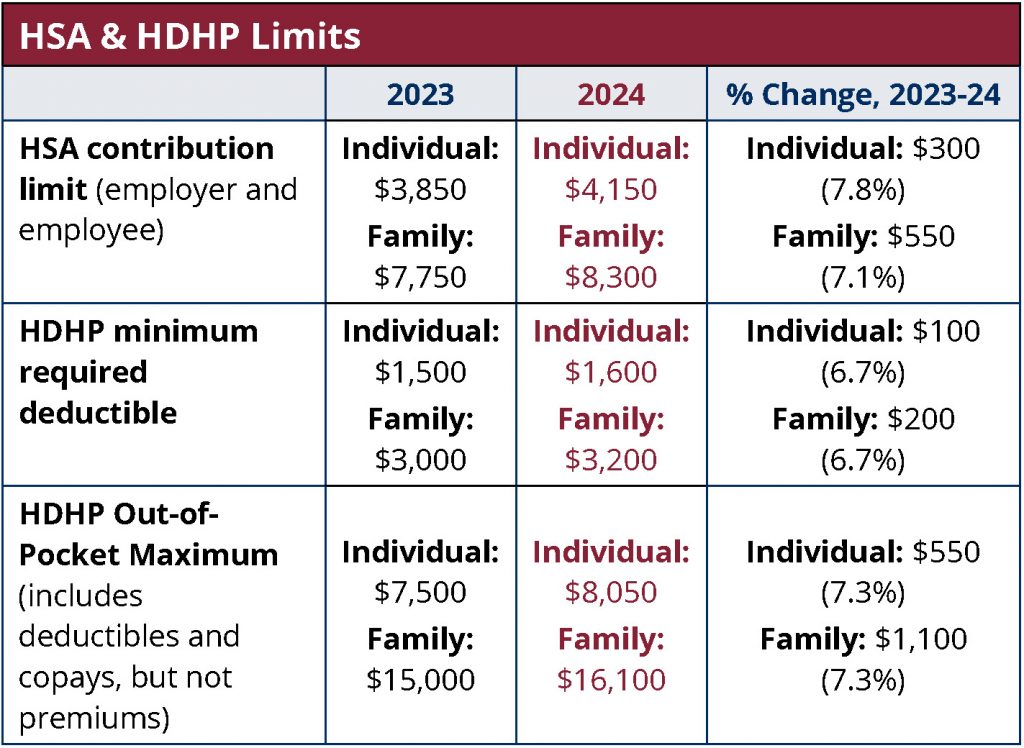

2025 HSA & HDHP Limits, Employees will be permitted to contribute up to $4,150 to an individual health savings account for 2025, the irs said tuesday. The hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families.

IRS Announces HSA Limits for 2025, The 2025 hsa contribution limits are as follows: The 2025 hsa contribution limits represent an increase from the 2025 amounts of $550 for family coverage and a jump of $300 if you have individual coverage.

Significant HSA Contribution Limit Increase for 2025, If you are 55 or older by. Hsa contribution limits for 2025 for 2025, the contribution limits increase again, allowing you to save up to the following amounts:

2025 HSA Contribution Limits Claremont Insurance Services, The maximum amount that may be made newly available for plan years beginning in 2025 for excepted benefit hras is $2,100 (up $150 from 2025). Hsa contribution limits for 2025 are $4,150 for singles and $8,300.

IRS Announces HSA Limits for 2025 Paysmart, Hsa contribution limits for 2025. If you are 55 or older by.

IRS Announces 2025 Limits for HSAs and HDHPs, Employee contribution limits for roth 401(k)s are $22,500 for 2025, and $23,000 for 2025, the same as traditional 401(k)s. Hsa contribution limits for 2025 for 2025, the contribution limits increase again, allowing you to save up to the following amounts:

2025 HSA Contribution Limit Jumps Nearly 8 MedBen, Your employer must notify you and the trustee of your. Employee contribution limits for roth 401(k)s are $22,500 for 2025, and $23,000 for 2025, the same as traditional 401(k)s.

New HSA/HDHP Limits for 2025 Miller Johnson, While some hsa match strategies may drive more engagement compared to others, any match can be a powerful employee incentive. That's not a negligible sum, and it's also really valuable given that employer matching dollars can be invested for.

2025 HSA contribution limits increase considerably due to inflation, The 2025 hsa contribution limits are as follows: That's not a negligible sum, and it's also really valuable given that employer matching dollars can be invested for.

That’s not a negligible sum, and it’s also really valuable given that employer matching dollars can be invested for.

The maximum amount that may be made newly available for plan years beginning in 2025 for excepted benefit hras is $2,100 (up $150 from 2025).